Launch your white label crypto exchange in just a few weeks - holistic, feature-rich cryptocurrency exchange software development.

Traditional crypto exchanges like Binance

Smart contract based crypto exchanges like Uniswap

A mix of Centralized & Decentralized exchanges

Cryptocurrency transactions are recorded on the blockchain, paving way for a decentralized value exchange. By creating a cryptocurrency exchange for yourself, you can be a part of the Billion dollar revolution that’s coming your way. Once you get to know the way exchanges work it would help you understand crypto buyer-seller trade behavior with ease.

Our well-knowledgeable experts are responsible for building a customizable trading software which enables secure and rapid transactions. Being an early adopter in Blockchain Technology, we implement best-in-class feasible solutions which are supported for a variety of industries.

CONNECT ON WHATSAPP

Allow traders to open and close orders in an instant. We can integrate a robust Spot Trading function into the trading engine that supports large amounts of orders without any glitches. Along with speed, our developers pay equal attention to security when building the platform, thus protecting your users against external threats.

Create a decentralized platform, where buyers and sellers can interact and settle trade directly. We offer white-labeled OTC platforms that promise a secure and seamless experience where customers can purchase or sell crypto assets without any hassles.

This emerging feature is a hit among traders. Earn steady commissions by lending funds to traders, enabling them to expand their market positions and multiply their profits. Additionally, we offer fund support to our customers with effective trading and risk-management strategies, which ensures zero loss.

Explore the lucrative feature of Future-Option trading where your customers can buy long or sell short crypto assets at predefined prices. By using smart contracts, we offer top-notch platforms that permit your customers to automate transactions by scheduling in advance and execute without supervision!

Empower customers to explore the power of their crypto assets by launching a fiat-to-crypto trading platform. Keeping the ease of liquidity in mind, your customers will enjoy a seamless experience when converting conventional fiat currency to crypto and vice-versa.

Engage with your customers better using our innovative marketing tools that allow you to take your cryptocurrency exchange to the next level. Introduce mining programs, broker systems, referral schemes, and other financial products that keep you at par with global competitors.

If you’re planning to get an exchange developed, consider answering the following questions before choosing the type of cryptocurrency exchange you’d like to invest in.

Do your target customers understand the cryptocurrency space, or do they just understand fiat?

How important is liquidity / order settlement / transaction speed for your customer base?

Are you in crypto-friendly jurisdictions?

How will the governance of the exchange work? Do you plan to involve a community for decision making?

Do you wish to provide fiat to crypto and vice-versa conversions?

Cryptocurrency trading started via White label Bitcoin exchange software and numerous cryptocurrencies have gained instant recognition among the digital community. But building a dedicated White Label Crypto Exchange Software from scratch is a tedious process, not to mention the heavy cost incurred during the designing and development stage.

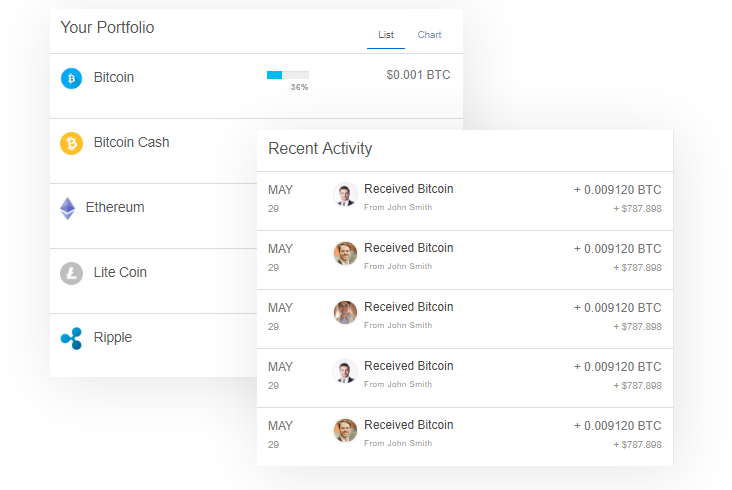

With our advanced white label cryptocurrency exchange software, you will receive state-of-the-art platform customized to suit your requirements. That's not all, our cutting-edge digital asset exchange software coupled with top of the line security features offer stellar performance for worry-free transactions. Our white label exchange solutions are designed to help you save on crucial time and unforeseen costs.

Cryptocurrency prices are prone to fluctuations. Retail traders who come to the exchange with minimal amounts are bound to experience losses through investments in a cryptocurrency.

In margin trading, exchanges enable retail traders and institutional traders to invest preferentially in specific cryptocurrencies;

Margin trading can provide increased profit potential to retail/institutional traders, as they prioritize their investments in specific cryptocurrencies

CFuture contracts are essentially betting on upcoming price fluctuations without ownership of the related assets.

To take part in a futures contract, people are required to furnish the marginal collateral amount (50%) from the contractual value and pay brokerage/exchange fees established by the exchanges.

In margin trading, exchanges enable retail traders and institutional traders to invest preferentially in specific cryptocurrencies;

Margin trading can provide increased profit potential to retail/institutional traders, as they prioritize their investments in specific cryptocurrencies

Copy-trading can be described as the mechanism through which users are provided the means to replicate the actions of trade leaders

This established ‘leader/follower’ relationship enables users to get profits by opting for leaders that suit their preferences with regards to return and risk

Additionally, users can copy multiple traders to optimize their risks and preferences

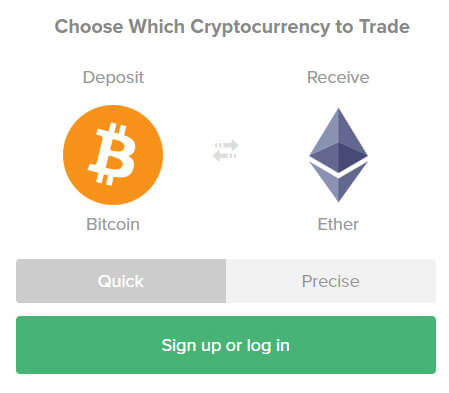

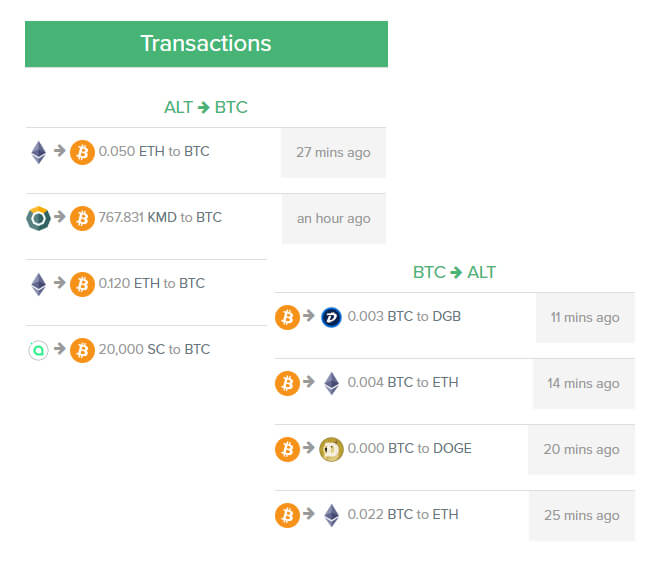

Unlike traditional cryptocurrency exchanges, One-Page Exchange speeds up the mechanism by eliminating the KYC process verification, deposit/withdrawal price, and simultaneously allowing trading between various cryptocurrencies. The One-page exchange offers crypto-enthusiasts & amateur investors a user-friendly interface and components such as matching engine, wallets and other functionalities supported in the backend. Contrary to other traditional cryptocurrency exchanges where tokens are used for availing transaction discounts or pay exchange fees, the one-page exchange allows tokens to be listed with the intent of trade.

One-page exchange, unlike centralized exchanges, has no intermediaries in the system via its wallet to wallet transaction mechanism.

Negotiations between parties are private and involve no interference from any middleman.

Since third-party negotiation is not involved, tailgating is eliminated and ongoing negotiation knowledge is restricted.

Users can rest assure with QR code authentication and Backup codes designed to ensure smooth login.

Most secure HTTP Authentication tokens, such as OAuth.

Prevention of multiple failed login attempts for a fixed amount of time.

Encryption of data transmission protects credentials and other information.

Protection against state-changing requests and other unwanted actions from the user side.

Defending the exchange against large requests to the server.

Protecting the exchange from overwhelming traffic originating from multiple sources.

Protection of internal systems from an attack sent from vulnerable web applications.

Evasion of Web Attack due to the HTTP request protecting hidden information.

The coin is exchanged between buyers and sellers using a trusted third party or smart contract.

The coins or tokens can be stored in secured e-wallets that are built on the blockchain to enable safe and secure storage of cryptocurrencies.

Multisignature adds an additional layer of security for cryptocurrency transactions. Multisignature wallet addresses require another user or users sign a transaction from the wallet.

Two-factor authentication (also known as 2FA) is a method of confirming a user's identity by utilizing two different factors, Private Keys & QR Scanner.

The wallet address consists of a public-key cryptography, based on the algebraic structure of elliptic curves over finite fields. The address will be in the form of an alpha-numeric structure.

The cryptocurrency exchange platform development that is chosen must have higher transactions per second and must be able to handle high volumes. The trading platform should be free from system crashes, server issues, and other irregular behaviors that could cause reputational issues.

The cryptocurrency market is volatile and it is important to be kept up to date on the market news and hedges. The exchange must be able to weather unexpected contingencies in the crypto-market.

The critical aspect of developing an exchange is to incorporate the company in crypto-friendly countries, with a focus on operating in a global market. Regulations, such as KYC, AML & GDPR, must be followed as per jurisdiction.

A secure banking facility is a highly critical component and the strategy must have an agreement with the bank as soon as possible. Depending on the location of the crypto-exchange, formal banking is not important.

Get in touch with us!

Whether you have a question about features, trials, pricing, need a demo, or anything else, our team is ready to answer all your questions